Streamline Your Payroll Processing in India

Tempus Payroll Module

Managing payroll can be a complex and time-consuming task, especially with India's intricate tax regulations and diverse workforce structures. Tempus Payroll Module is designed to simplify and automate your entire payroll process, ensuring accuracy, compliance, and efficiency. This robust solution empowers your organization to handle salaries, deductions, and statutory compliances with ease, freeing up valuable HR resources to focus on strategic initiatives.

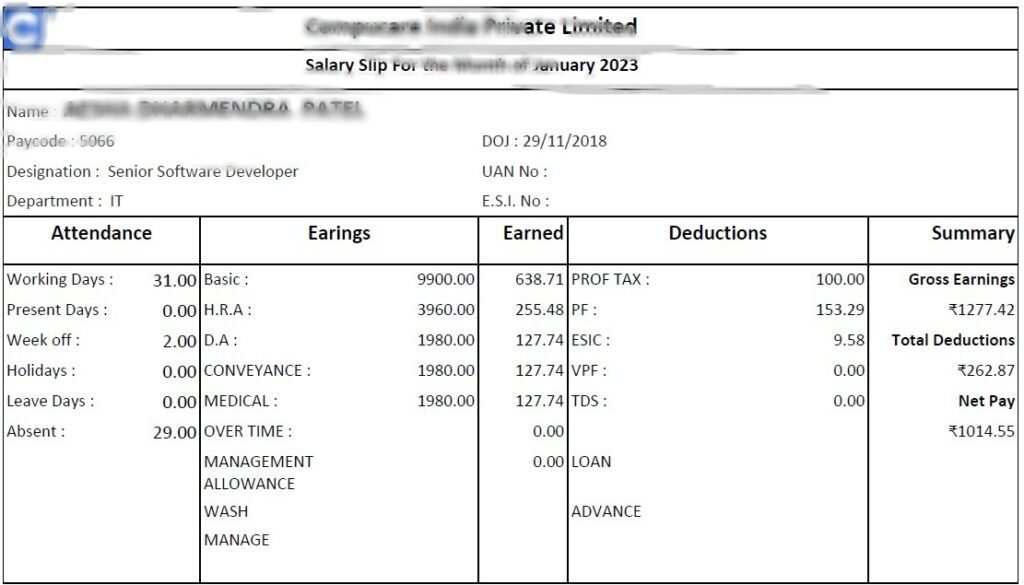

Automated & Accurate Salary Processing

Say goodbye to manual errors and tedious calculations. Our Tempus Payroll module automates salary processing based on attendance, leaves, and configured pay scales.

Automated Calculation: Seamlessly calculates gross pay, allowances, and deductions.

Configurable Pay Structures: Adapts to various salary components and employee grades.

Error Reduction: Minimizes human error, ensuring precise payments every time.

"Showing up every day with a positive attitude can change the entire culture of a workplace"

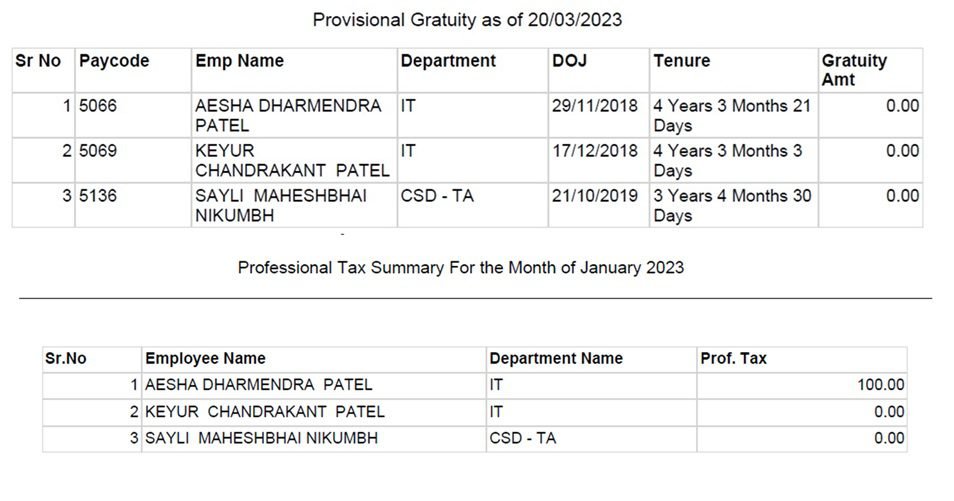

Comprehensive Statutory Compliance

Navigating India’s dynamic regulatory landscape is crucial. Our Tempus Payroll solution is built with an in-depth understanding of Indian statutory requirements.

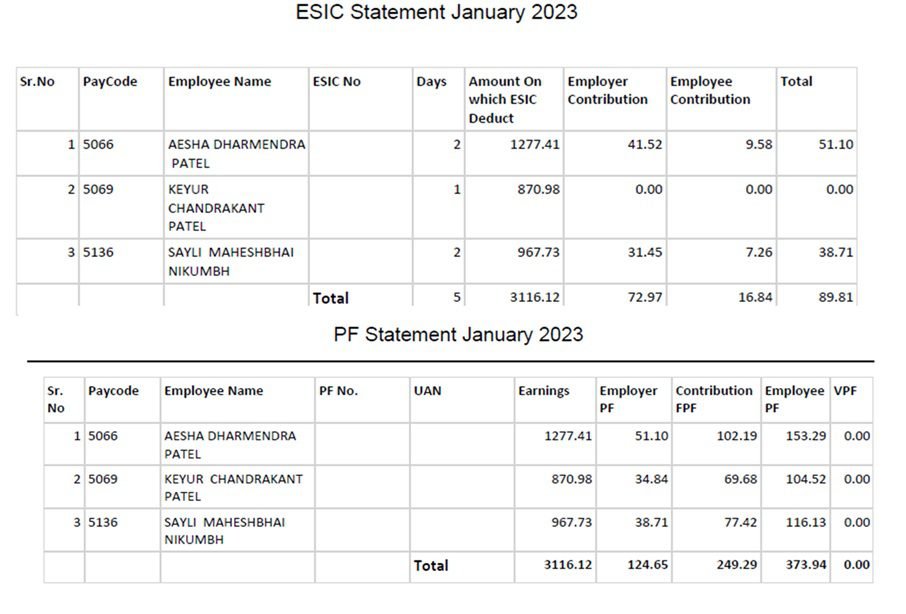

Provident Fund (PF): Manages PF contributions, remittances, and ECR filing.

Employees’ State Insurance (ESI): Handles ESI contributions and online challan generation.

Professional Tax (PT): Calculates and manages Professional Tax as per state regulations.

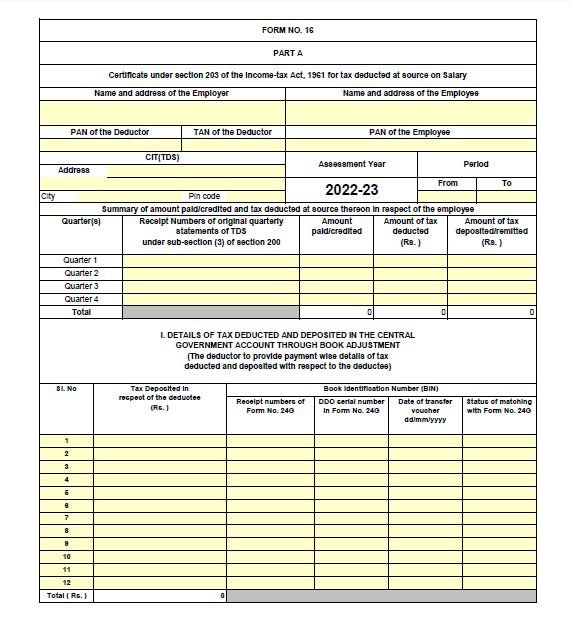

TDS (Tax Deducted at Source): Accurate TDS calculation, deduction, and generation of challans and forms (Form 16/16A).

Labour Welfare Fund (LWF): Manages LWF deductions and compliances where applicable.

Arrange A Demo

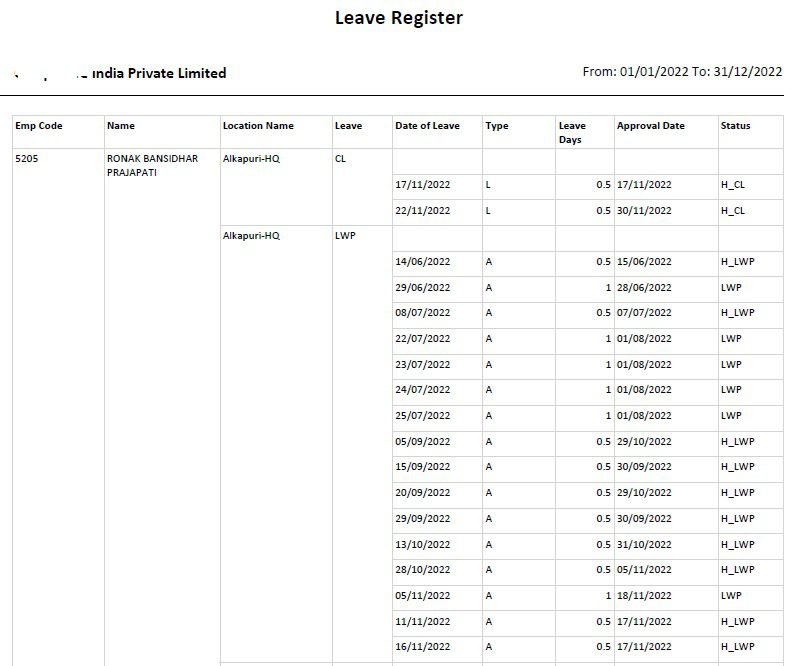

Integrated Leave & Attendance Management

For a truly streamlined process, our Payroll module seamlessly integrates with Tempus Central’s Attendance and Leave Management systems.

Real-time Data Sync: Payroll calculations automatically factor in approved leaves and recorded attendance data.

Policy Enforcement: Ensures payroll adheres to your company’s leave policies.

Eliminate Discrepancies: Reduces disputes related to pay based on attendance.

Robust Reporting & Analytics

With Tempus Payroll module, gain valuable insights and simplify audits with comprehensive reporting tools.

Customizable Reports: Generate various payroll reports, including pay slips, salary registers, and statutory summaries.

Audit Readiness: With real time data, Tempus Payroll Module offers customers readiness for audit, anytime through the year. With clear and well structured reports associated with documented records, makes it easy for auditors.

Data-Driven Decisions: With graphical reports and data pointers, it helps HR team to analyze payroll costs and trends for better financial planning. With these insights, Tempus payroll module saves costs, indirectly

Why Choose Tempus Payroll for Your Indian Business?

Indispensible

In the complex operational environment of Indian businesses, particularly in manufacturing and industrial sectors, a robust Tempus Payroll system is indispensable.

Compliance Ready

We provide a solution that not only simplifies your processes but also guarantees adherence to all legal requirements, mitigating risks and enhancing operational efficiency. Focus on your core business while we handle your payroll with precision and expertise.

No Obligation Demo

Ready to transform your payroll processing? Contact us today for a personalized demo of the Tempus Payroll Module!

Tempus Payroll is a comprehensive and intelligent payroll management solution designed to automate and simplify your entire payroll process. It handles everything from calculating employee earnings and deductions to managing statutory compliance and generating essential reports, ensuring accuracy and efficiency.

Yes, absolutely. Tempus Payroll is highly flexible and customizable. It allows you to define and manage a wide range of compensation structures, including various allowances, benefits, and deductions tailored to different employee groups and company policies.

Tempus is specifically designed to manage all Indian statutory requirements. It automatically calculates and deducts Provident Fund (PF), Employees’ State Insurance (ESI), Professional Tax (PT), and Income Tax (IT) as per the latest government regulations. It also facilitates the generation of compliance reports like Form 24Q, Form 16, and ESI Challans.

Yes, it integrates seamlessly! Tempus Payroll works in conjunction with other Tempus Central modules, including attendance and leave management. This integration ensures that payroll calculations are based on accurate working days, approved leaves, and overtime, minimizing manual intervention and errors.

empus Payroll offers a wide array of reporting capabilities. You can generate detailed payslips, salary registers, bank statements for salary disbursement, various tax reports (like Form 24Q, Form 16), ESI challans, and customized analytical reports to gain deeper insights into your workforce compensation.

Yes, our automated payroll processing solution is scalable and designed to meet the needs of organizations of all sizes, from small teams to large enterprises with thousands of employees. Its flexibility allows it to adapt as your business grows.

Data security is a top priority. Tempus Payroll is built with robust security measures to protect sensitive employee and financial information, ensuring data confidentiality, integrity, and availability through advanced encryption and access controls.

Client Testimonials

What Tempus clients say....

Hema Solanki

HR- ABC AutolinksI am using Tempus for last three years and I am happy with it! Thank you so much!

Rajni Thapa

HR - SEELinkages Pvt Ltd.Last five years, we are using Tempus. The product and support is good.

Krunal Bhagat

HR Manager- Kalamandir JwellersAt Kalamandir, we are using Tempus from 2015. It is easy to use and we get good support!